The way that we pay is changing as the world becomes increasingly less reliant on cash. But as the cashless boom takes over, which US cities are most prepared for it?

It turns out that certain cities have embraced the cashless way of life much more than others. While some cities have emerged as hotspots for cryptocurrency, other destinations are havens for Apple Pay.

mBit Casino has analyzed 40 of the largest cities in the US to determine which location is the most prepared to go completely cashless, by having the highest number of businesses accepting contactless and cryptocurrency payments instead of cash.

Across 40 of the largest cities in the US, the study found that an estimated 74% of businesses accept Apple Pay in 2025. Meanwhile, an average of 17 businesses per city accept cryptocurrencies like Bitcoin as tender in 2025.

Key Findings:

- Philadelphia is the number one city most ready to go cashless in the USA

- Atlanta has embraced Apple Pay the most, with 95% of local businesses accepting this type of payment

- New York City is leading the crypto revolution, with a total of 94 local businesses letting customers pay with cryptocurrencies

- Cash is still king in Texas, where San Antonio and Fort Worth are the least prepared cities to go cashless

- There are more than 5,600 businesses across the US that allow customers to pay using crypto in 2025. 699 of these are in the 40 largest US cities

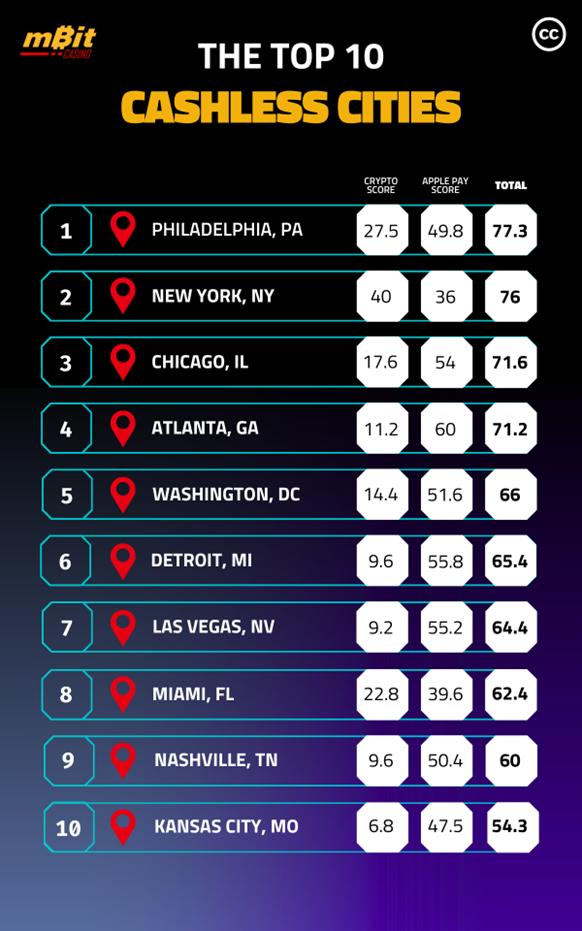

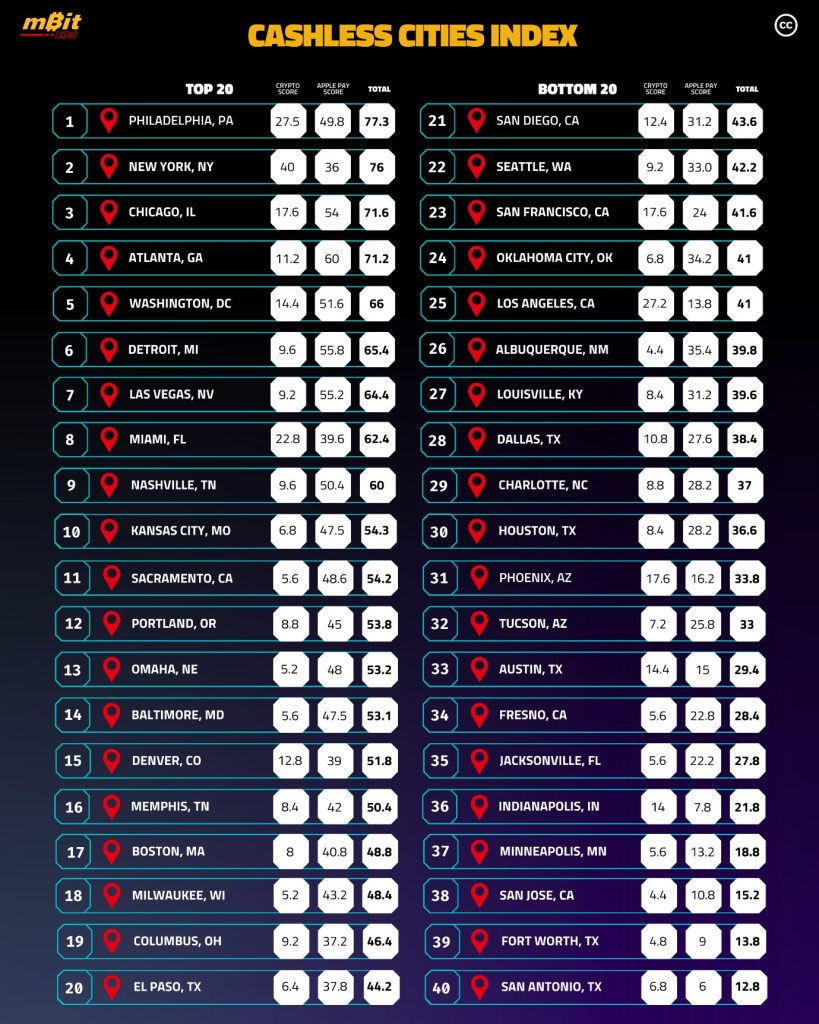

The top 10 cashless cities in the US

The study crowned Philadelphia as the number one city most ready to go completely cashless. Philadelphia was given the best total score in the study with 77.3 out of 100. The City of Brotherly Love truly loves being able to pay the cashless way, as a huge 84% of businesses in Philadelphia were found to accept Apple Pay.

Philadelphia also had one of the highest numbers of businesses accepting cryptocurrency payments. In fact, 45 businesses in Philly accept currencies such as Bitcoin as tender. A staggering 69% of those businesses are finance-related, which includes banks, ATMs, and more. Some of the more niche businesses accepting cryptocurrency payments in Philadelphia included a veterinary surgery and a wine bar.

Next up were New York City in second place with a score of total score of 76 out of 100, and Chicago in third place with a total score of 71.6 out of 100.

New York’s high ranking in the study was largely due to it being the city that has embraced cryptocurrencies the most, with 94 New York-based businesses accepting cashless payments through crypto, including everything from coffee shops to cleaning services.

Whereas Chicago’s high ranking in the study was largely because more than nine out of ten businesses in the Windy City currently accept Apple Pay. In fact, nine in ten of Chicago businesses allow customers to pay this way.

The rest of the top five was made up of Atlanta in fourth, which had the highest percentage of businesses accepting Apple Pay (94.8%) to score 71.2 out of 100, plus Washington, DC in fifth, where 26 businesses allow cryptocurrency payments, to score 66 out of 100 in the study.

The rest of the top 10 featured Detroit, Las Vegas, Miami, Nashville, and Kansas City, all of which are set to go cashless.

On the flipside, there are some US cities where cash is still king. San Antonio was ranked the least ready to go cashless in the study, with a low score of 12.8 out of 100. Surprisingly, a little over half (52%) of San Antonio businesses were found to accept Apple Pay in 2025, and just seven businesses were found to accept crypto payments.

Staying in Texas, Fort Worth was found to be the second-least ready city to go cashless in the study. Meanwhile, the likes of San Jose, Minneapolis, and Indianapolis all emerged as some of the cities most reliant on cash.

The overall results showed that an average of 74% of businesses across the 40 largest US cities accept Apple Pay. Specifically, at least 52% or more businesses in the 40 largest US cities are allowing customers to use Apple Pay in 2025, and in the 20 largest US cities, this percentage figure rises to 76% or more.

Meanwhile, the study uncovered 699 businesses in the 40 largest US cities that are allowing customers to pay using cryptocurrency in 2025. Further research shows that there are 5,632 businesses across the entire United States that allow customers to pay using cryptocurrency.

A spokesperson for mBit Casino commented on the study findings:

“The results show that the U.S. is moving toward a cashless future faster than most people might expect.

“The bigger cities like New York, Chicago and Philadelphia are already using Apple Pay almost everywhere, and now crypto is starting to become present in everyday businesses.

“As three-quarters of major cities’ businesses are accepting mobile payments, tapping to pay is becoming the new normal. What’s interesting is how widespread this shift is.

“Even cities near the bottom of the rankings still have more than half of their businesses accepting Apple Pay, which is a percentage that has increased over the years.

“This demonstrates that cashless habits aren’t just happening in tech-focused areas, but they are spreading across the country as people look for an easier, faster and more secure way to pay in every area of their day to day lives.”

Which cities have embraced cryptocurrency the most?

No US city has embraced the Bitcoin boom more than New York City, as it is crowned the number one city to pay for services using cryptocurrencies. New York scored 40 out of 40 in the crypto category, as a total of 94 New York-based businesses allow customers to pay using cryptocurrencies such as Bitcoin. Financial businesses (57) are the dominating sector for accepting crypto payments. Meanwhile, New Yorkers can also pay for automotive services, food and drink, hair and beauty treatments, and much more using cryptocurrency.

New York has more than double the number of businesses accepting crypto than the next-best city, which is Philadelphia, ranked second with a category score of 27.5 out of 40. Pennsylvania has a total of 45 businesses accepting crypto, and again, the financial sector dominates, with 31 out of the 45 Pennsylvania-based businesses accepting crypto, including banks, ATMs, and other financial services.

Los Angeles ranks third, achieving a score of 27.2 out of 40. 58 of L.A.’s businesses allow customers to pay using crypto, including an exceptionally large number of medical services. In fact, nine businesses in L.A. allow customers to pay for medical services using cryptocurrencies like Bitcoin.

Rounding out the top five are Miami (22.8 out of 40) and Chicago (17.6 out of 40). Both of these cities are hotspots for food and drink businesses that allow customers to pay using cryptocurrency, with 40 eatery establishments between them.

On the flipside, the cities that are yet to embrace the crypto boom include Albuquerque, San Jose, Baltimore, Omaha, and Milwaukee. The study found just 11 businesses between these five cities that allow customers to pay using Bitcoin or other types of cryptocurrencies.

Albuquerque was the least savvy of the lot. In fact, only one business in the Duke City, an educational institution, accepts crypto payments.

A spokesperson for mBit Casino commented on the study’s cryptocurrency findings:

“New York is leading the way in cryptocurrency payments, particularly in the financial sector, the city is setting a trend for the rest of America to follow.”

“Our findings also show that the variety of businesses and services embracing cryptocurrency throughout the country is expanding, with everything from hotels to realtors, and restaurants to legal services getting on board.”

“For businesses, accepting crypto can help to improve speed and reduce fees, and consumers benefit from more payment options and spending investments.”

“More than one in five (21%) of American adults own some form of cryptocurrency, which is roughly equivalent to 55 million people.”

“Not every city is on board yet, but crypto payments are on the rise. Big cities are already showing that digital currencies can work alongside cards and Apple Pay.”

Which cities have embraced Apple Pay the most?

The city that has embraced Apple Pay the most in America is Atlanta, where 94.8% of businesses allow customers to pay using this method. The Gate City achieved a perfect Apple Pay category score of 60 out of 60.

The most common types of businesses where you can expect to use Apple Pay in Atlanta are restaurants. Out of 55 restaurants analyzed in Atlanta, all 55 of them accept it. Meanwhile, 94% of Atlanta’s fast-food places accept Apple Pay, and 85% of its Supermarkets do too. However, despite being an Apple Pay hotspot, only 27% of parking lots accept it in Atlanta, the least of the 40 largest US cities.

The second-best city for using Apple Pay in the US is Detroit, with 90% of its businesses accepting it, the Motor City scored 55.8 out of 60 in the Apple Pay category. All of the city’s restaurants accept Apple Pay, and 90% of its supermarkets do too.

Las Vegas is the third-best city for paying with Apple Pay in the US, achieving a score of 55.2 out of 60. 89.8% of Las Vegas-based businesses accept Apple Pay, including 100% of its gas stations, and 92% of its bars.

Completing the top five are Chicago (54 out of 60) and Washington, DC (51.9 out of 60). 100% of fast-food places allow customers Apple Pay in both cities.

On the flipside, the cities that are still yet to fully embrace Apple Pay include San Antonio, Indianapolis, Fort Worth, San Jose, and Minneapolis.

San Antonio has the fewest businesses allowing customers to pay using Apple Pay (52%), scoring 6 out of 60. Only 49% of the city’s supermarkets accept Apple Pay, and 25% of its bars allow this kind of payment method too, the lowest percentages of all 40 cities.

A spokesperson for mBit Casino commented on the study findings:

“Apple Pay continues to gain momentum as consumers seek faster and more secure ways to purchase. Major cities are predominantly implementing Apple Pay in key sectors such as supermarkets and restaurants and supermarkets.

“However, some businesses still skip Apple Pay as they are worried about the hassle of upgrading old payment systems or simply don’t feel the pressure to change what already works. Others are uneasy about potential fraud and chargebacks.

“Apple Pay is only going to become more common as stores upgrade their tech and people get used to tapping instead of swiping.”

Philadelphia and New York are ready to embrace a cashless future, with San Antonio and Fort Worth the furthest behind

Methodology

- The study aimed to identify the US cities that have most embraced cashless methods of paying for goods and services.

- A seed list of 40 of the largest cities in the US was included in the study, sourced using the latest 2024 census population data.

- The study tested all 40 cities on the same two determining category factors: Apple Pay and cryptocurrency.

- The total number of businesses accepting Apple Pay in each city was sourced via Apple Maps. The seven types of businesses included here were restaurants, fast food places, coffee shops, supermarkets, bars, parking lots, and gas stations.

- It must be noted that the Apple Maps source only provides up to 55 of each type of business per city. Therefore, each city received a percentage score using the data provided by Apple Maps. For example, if 55 out of 55 gas stations in Las Vegas accepted Apple Pay, then the study recorded that 100% of Las Vegas gas stations accepted Apple Pay.

- The total number of businesses accepting cryptocurrency in each city was sourced via btcmap.org. The raw figures were recorded and used in this study.

- The cities with the highest percentage of businesses accepting Apple Pay received a higher score out of 60. The cities with the highest percentage of businesses accepting cryptocurrency received a higher score out of 40. These combined category scores provided each city with a total score out of 100, which was used as the study’s final determining ranking factor.